Modification to EU VAT – July 2021 and Fastbay

Following the significant changes to the way EU imports are handled for VAT, let’s take a look at what changes eBay will be applying and how Fastbay will be handling it.

From 1 July 2021, the EU will introduce significant changes to how VAT is collected on imports into the EU, supplies within the EU by non-EU sellers and cross border supplies by EU sellers. eBay is obliged to collect VAT on goods sold through eBay to EU customers in the following circumstances:

- Goods imported into the EU, with a parcel value of up to EUR 150. Note that there is no longer a VAT exemption for small consignments up to EUR 22.

- Goods of any value sold by a non-EU seller and shipped from inventory stored in the EU. Sellers may still have EU VAT obligation and should consult their tax advisors for further information.

- If an order fits either of these criteria, neither sellers nor carriers should collect VAT from buyers in the EU. eBay will collect the VAT from the buyer based on the country of delivery and remit it to the responsible tax authorities.

Requirement of IOSS Number on EU Imports:

Where eBay has collected VAT on your shipment to the EU (up to a consignment value of 150€), eBay will provide sellers with eBay’s IOSS number to use as part of the import information. Sellers should only use this number in connection with eBay transactions. Where eBay becomes aware of seller misuse of the eBay IOSS number, eBay will take necessary actions against the seller.

- Sellers must provide eBay’s IOSS as part of the electronic export pre-notification documentation provided to carriers. If eBay’s IOSS is not provided correctly, then buyers may have to pay VAT again on delivery.

How this will impact the operation of Fastbay and what new features have been introduced in the module:

- Sending the correct VAT rate when synchronising products

When synchronising a product, Fastbay always sends eBay information about the VAT rate in use based on the default “tax rule group” configured in the Prestashop product sent from the website.

Keep in mind that sending the VAT rate to eBay will NOT increase the price visible to the buyer on eBay (which will remain the price calculated by the module following any configurations / mark-ups etc.), but will just inform eBay about the VAT rate percentage of the synchronized product pirce.

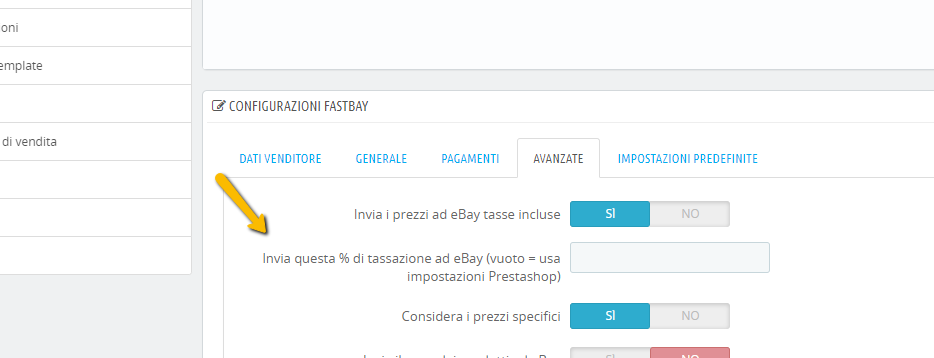

For VAT rate synchronization to happen, of course, the option “Prices including taxes” must be enabled in the general configurations of the module.

The only case in which no information is sent to eBay is the case of a product under ‘No tax’ rule.

Starting from version 6.5.0 of the module (compatible with Prestashop 1.7 and above)

the possibility of forcing a dedicated VAT rate by bypassing Prestashop’s options on a given marketplace has been included:

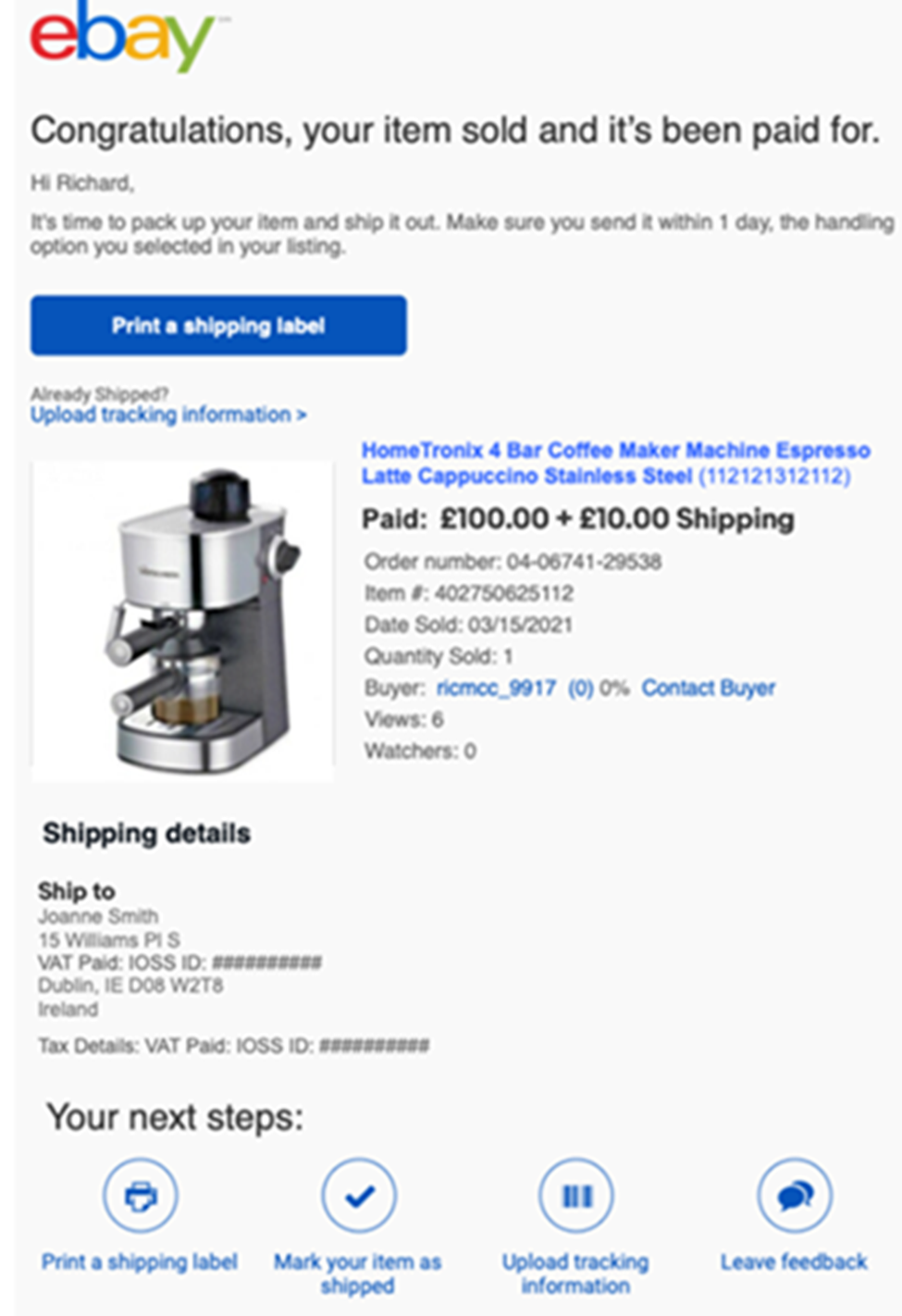

- How to find the IOSS code on a shipment where VAT had been withheld by eBay

For all orders where it is necessary to find the IOSS code, additional data will be sent as an “additional line” of the customer’s address, this data will be imported into Prestashop, in the “address2” field of the user address :

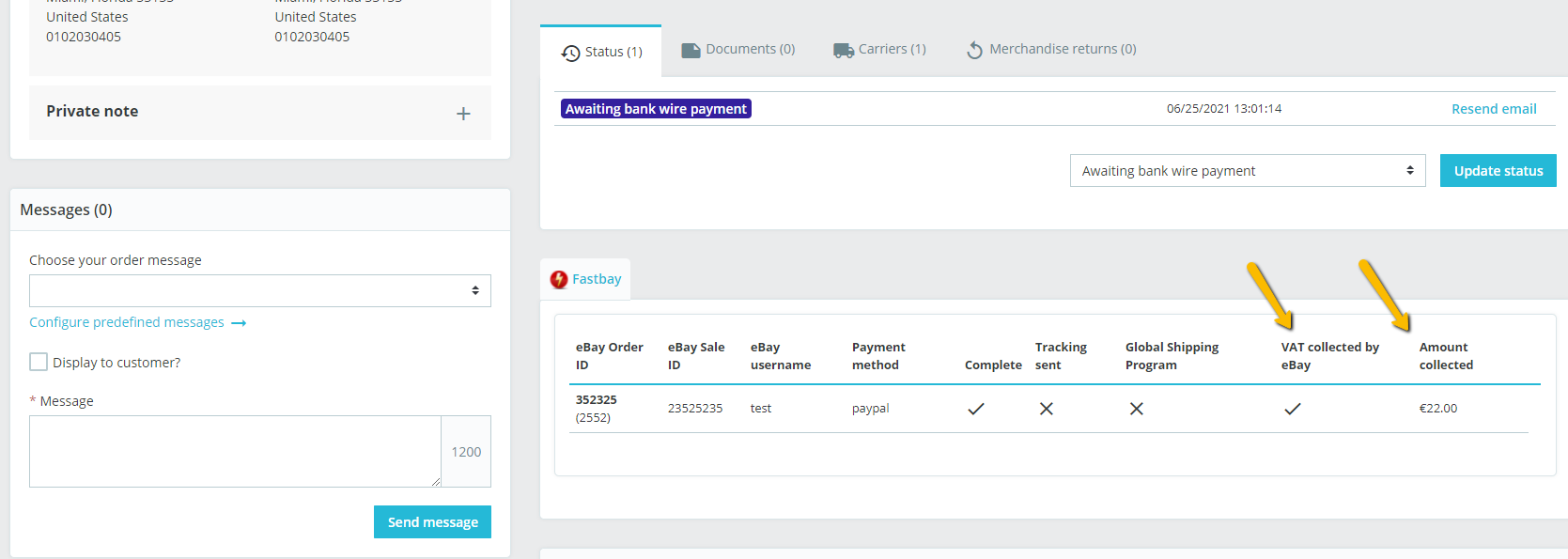

- Ability to see on screen the amount of VAT withheld by eBay

Starting from module version 6.5.2 (compatible with Prestashop 1.7 and higher), Fastbay will show whether an order is subject to VAT “collect and remit” by eBay or not.

If so, it will show the amount – This data will be saved to the database for any need to be sent to CRM / management or third party tools :

HOW TO RECEIVE THE UPDATE

In order to stay aligned with all brand new module features, keep your Fastbay copy up to date.

If you already have the previous version and a valid 12 month Zen upgrade license, you can download the new version from your account in our webshop. Alternatively you can request it for free by opening a ticket in our support area : support.prestalia.it

If you are not entitled to upgrade, however, you can purchase the new module directly on shop.prestalia.it or renew your Zen option by clicking here.